Tighter Loan Conditions

KUALA LUMPUR: BANK Negara Malaysia has introduced a slew of new financing measures to rein in escalating household debt in the country.

The mea

sures include limiting personal financing loans to a maximum of 10 years from 25 years and property loans to a maximum of 35 years from 45 years.

The central bank has also prohibited the offering of pre-approved personal financing products, such as unsolicited pre-approved credit cards.

The measures, which take effect immediately, will impact 33 financial institutions and close to 500 cooperatives in the country which provide financing means to cover the purchase of residential and non-residential properties, transport vehicles, credit cards, securities and personal use.

Earlier this week, Second Finance Minister Datuk Seri Ahmad Husni Hanadzlah said household debt had risen to 83 per cent of the gross domestic product, placing Malaysia as one of the highest in the world.

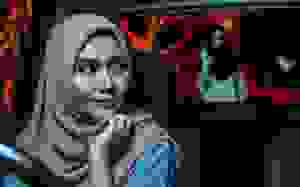

Explaining the move, central bank governor Tan Sri Dr Zeti Akhtar Aziz said household debts, which stood at 70 per cent of the GDP in 2009, had increased at a strong pace since, averaging at an annual rate of 12 per cent.

“It has not reached an alarming stage yet but with the current external risks to growth, this has raised the concern of affordability and sustainability of the household sector,” she said, adding the regulation had also just come into force.

Apart from properties which form the bulk of household debts with 44.5 per cent of the total, personal loans contributed 16.8 per cent of household debt.

In a briefing to news editors yesterday, she described the reduction in tenures for personal financing and property loans as reasonable.

“Even if household debt has been supported by positive income and employment conditions, there has been a trend in the offering of financial products that are not in the long-term interests of consumers.

“While this may reduce monthly repayments, in the long run, this increases the overall debt burden of households.”

As such, key credit providers are required to ensure that the debt service ratios of vulnerable groups should not exceed 60 per cent, so as to ensure households have sufficient financial buffers to protect them against rising costs and unexpected adverse events.

“However those households which have the financial capacity to take on borrowings will continue to enjoy access to financing.”

The banking industry, she said, welcomed the measures and was keen to reduce the level of indebtedness which can affect the financial sector as well as the growth of the economy.

Banks have been told not to cut back on credit lines with the introduction of the new measures.

Commenting on the previous measures by the central bank, she noted that there had been improvements in the credit card category as well as for automobile financing.

Source

Artikel ini hanyalah simpanan cache dari url asal penulis yang berkebarangkalian sudah terlalu lama atau sudah dibuang :

https://ccris.com/2013/07/29/tighter-loan-conditions/

PING BABAB : Raksasa Aggregator Malaysia

PING BABAB : Raksasa Aggregator Malaysia

sures include limiting personal financing loans to a maximum of 10 years from 25 years and property loans to a maximum of 35 years from 45 years.

sures include limiting personal financing loans to a maximum of 10 years from 25 years and property loans to a maximum of 35 years from 45 years.